Securing 421-a(16) Tax Exemption Eligibility

by Anna Martynova

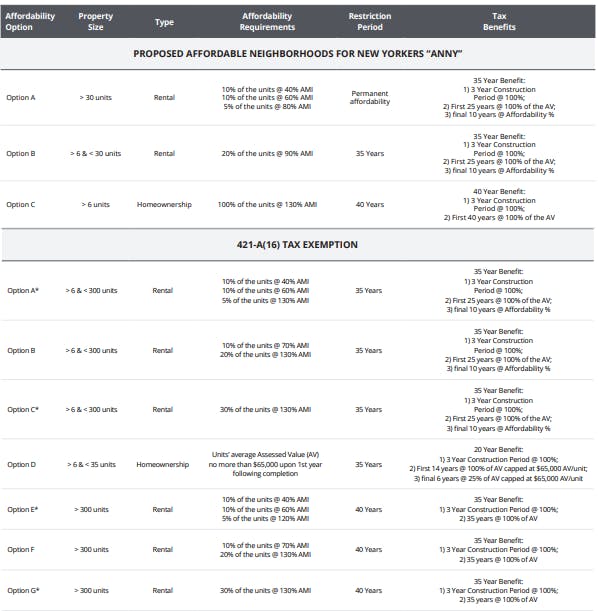

As a part of the proposed 2023 FY budget, New York State Governor Kathy Hochul released the details about the new program called Affordable Neighborhoods for New Yorkers (“ANNY”). The program is proposed to replace the existing 421-a(16) Tax Exemption that is approaching a sunset date on June 15, 2022. Although the deadline is only a few months away there is still time for new projects to secure eligibility for the program.

CONSTRUCTION COMMENCEMENT DEADLINE

Per 421-a(16) Tax Exemption requirements, construction for eligible multiple dwellings must commence on or before June 15, 2022. Construction commencement would be considered the date upon which excavation and construction of initial footings and foundations lawfully begins or, for an eligible conversion, the date upon which the actual construction of the conversion, alteration, or improvement of the pre-existing building or structure lawfully begins.

ELIGIBLE DOB PERMITS

A project could meet 421-a(16) construction commencement deadline if it receives one of the following permits and commences work on or before June 15, 2022:

1. New Building (NB) permit;

2. Alteration Type 1 (ALT 1) permit;

3. Alteration Type 2 (ALT 2) permit issued in conjunction with an NB, Foundation permit (FO), or ALT 1 permit (if the permits are issued under the same job number);

4. Foundation permit (FO) issued earlier than either an NB or ALT 1 permit issued under:

• the same job number as NB or ALT 1 permit

• a different job number that indicates the FO permit is being issued in conjunction with said NB or ALT 1 permit

PROJECTS APPLYING FOR INCLUSIONARY HOUSING (IH)

Projects opting into Inclusionary Housing Program do not require approval from the IH unit to receive an SOE and/ or foundation permit. Nonetheless, we strongly encourage documenting construction commencement with photos and/or special inspection report to avoid any potential challenges that the Agency could raise in regards to construction commencement date in the future.

THE NEW PROGRAM AFFORDABLE NEIGHBORHOODS FOR NEW YORKERS (“ANNY”)

The new program is proposed to be available for the projects that did not receive 421-a(16) Tax Exemption benefits and commencing construction between June 15, 2022, and June 15, 2027. Please note that the program is subject to further approval by the Senate and Assembly. Although it’s possible that conversions from the old program to the new one would be allowed, it is safer to ensure your projects are eligible for the existing 421-a(16) Tax Exemption program that is offering higher rents for affordable units. It is currently not clear if ANNY program will be passed as proposed.

Affordability options

- Rental developments with over 30 units – 25% Affordability

º 10% of the units @ 40% AMI

º 10% of the units @ 60% AMI

º 5% of the units @ 80% AMI

- Rental developments with less than 30 units – 20% Affordability

º 20% of the units @ 90% AMI • Condo/co-op developments

º 100% of the units @ 130% AMI replacing the current 421-a program’s use of property assessment

Tax benefits

- Rental developments

º 100% Tax exemption for up to 3 years for construction period

º 100% Tax exemption for 25 years post construction completion

º For the last 10 years, the percentage of the tax exemption would be equal to the affordability percentage - Condo/co-op developments

º 100% Tax exemption for 40 years post construction completion

º 100% Tax exemption for up to 3 years for construction period

Restriction period

- Rental developments with over 30 units

º Permanent affordability - Rental developments with less than 30 units

º Affordability component must be maintained for 35 years after construction completion - Condo/co-op developments

º Affordability component must be maintained for 40 years after construction completion

Minimum wage&Labor requirements

Projects located in Prime Development Areas (PDAs) fka Enhanced Affordability Areas (EEAs) would require the following established rates to be paid to construction workers:

- Rental projects with 300 or more units

º $63/hour minimum in Manhattan

º $47.25/hour minimum in Brooklyn/Queens

º 5% increase after year 1, and then every 3 years thereafter

The following projects are not subject to the minimum wage requirement:

- Condo/co-op developments

- Rental developments with 50% or more of the units allocated to affordable housing at up to 80% AMI

- Rental developments with Project Labor Agreement (PLA)

Program duration

ANNY program would be set for five years after the expiration of 421-a(16) Tax Exemption:

- Construction commencement: June 16, 2022 – June 15, 2027

- Construction completion: June 15, 2031

THE MAIN CHANGES

• Deeper Affordability

º Although the newly proposed ANNY program will be offering tax benefits that are similar to the existing 421-a(16) Tax Exemption, it will have deeper affordability options for the rental projects.

• Rents

º The rents under the new program will be capped at 90% AMI which will reduce the rents that could be charged for the affordable units significantly.

• Affordability Restriction Period

º The affordability component for the developments with over 30 rental units would require to be permanently affordable.

• Better Homeownership Option

º The new program is proposed to provide more benefits for homeownership projects and contains an option for 100% affordable homeownership projects to receive tax benefits.

WHICH PROGRAM WOULD WORK BEST?

If ANNY is adopted as proposed the projects listed below could benefit from the program:

• Projects opting into Inclusionary Housing program

º The affordability requirements of the newly proposed program closely align with the affordability requirements of the Inclusionary Housing Program

º For projects with over 30 rental units MIH option 1 would have very similar affordability/ AMI requirements to ANNY program.

º For projects with less than 30 affordable units VIH program would have similar affordability/ AMI requirements to ANNY program.

• Projects under with less than 30 rental units

º Small rental developments could benefit from a smaller percentage of the units that would have to be allocated to affordable housing while having the highest allowed rents/AMI level under the new program.

• Homeownership projects

º The new program is proposed to offer better property tax benefits for homeownership projects - a 40-year benefit period at 100% tax exemption.

º 100% of the units in the building can be sold to applicants @ 130% AMI. This option offers the highest AMI option.